Introduction

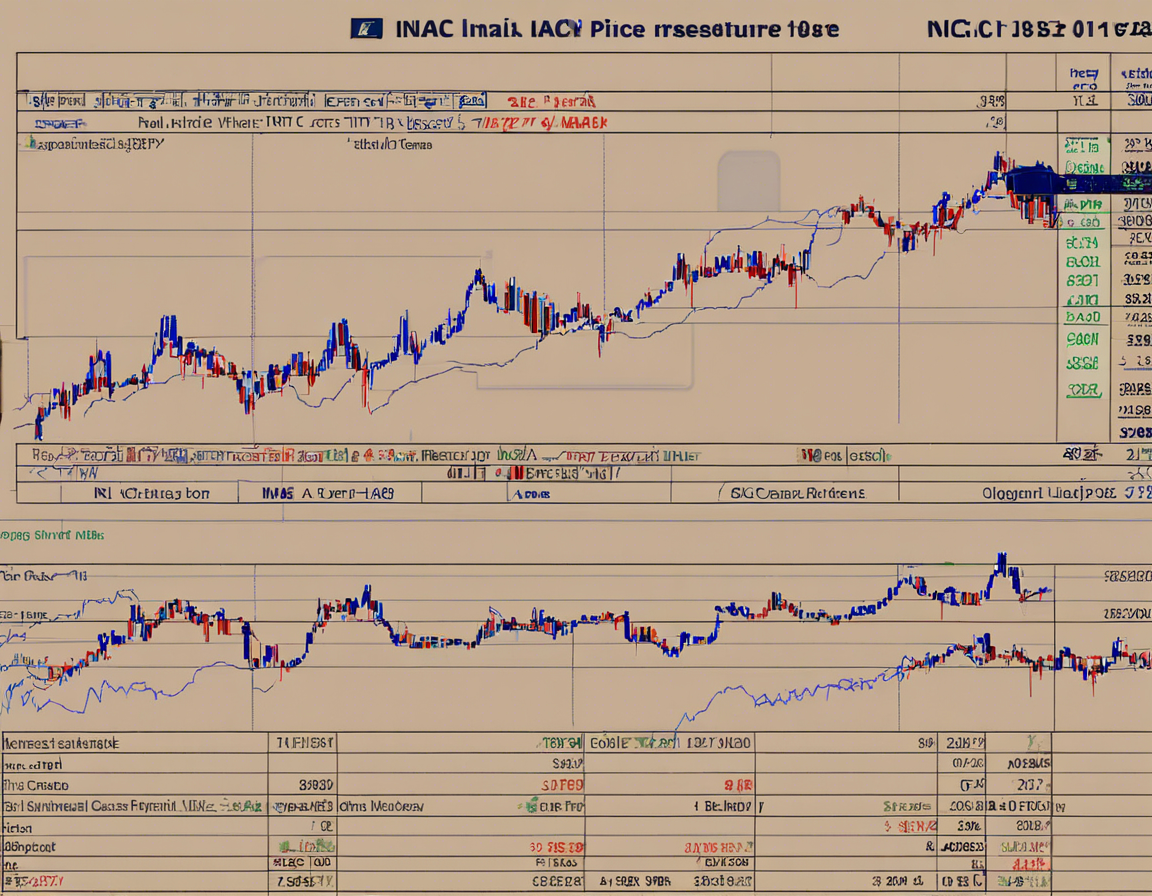

Analyzing NIACL (New India Assurance Company Limited) share price trends can provide valuable insights for investors, traders, and stakeholders in the stock market. Understanding the factors that influence the movement of NIACL’s share price can help in making informed decisions and devising effective investment strategies.

Historical Performance

One way to gauge the performance of NIACL’s share price is to look at its historical trends. By analyzing the historical data of the company’s share price, investors can identify patterns, trends, and key levels of support and resistance. This analysis can provide valuable insights into the potential future movements of the share price.

Factors Influencing NIACL Share Price

Several factors can influence NIACL’s share price, including:

1. Company Performance: The financial performance of the company, including revenue growth, profitability, and market share, can impact its share price.

2. Industry Trends: Trends in the insurance industry, such as changes in regulations, competitive landscape, and market conditions, can affect NIACL’s share price.

3. Macroeconomic Factors: Economic indicators like GDP growth, inflation rates, interest rates, and currency fluctuations can impact NIACL’s share price.

4. Market Sentiment: Investor sentiment, market speculation, news, and events can also influence the share price of NIACL.

Technical Analysis

Technical analysis is another crucial tool for analyzing NIACL’s share price trends. By studying charts, patterns, and technical indicators, investors can identify potential entry and exit points, trends, and price levels that may act as support or resistance.

Key Levels to Watch

Identifying key levels in NIACL’s share price can help investors make better trading decisions. Key levels to watch include:

1. Support Levels: These are price levels where the share price tends to find buying interest and reverse its downward movement.

2. Resistance Levels: These are price levels where the share price faces selling pressure and struggles to move higher.

3. Moving Averages: Moving averages, such as the 50-day and 200-day moving averages, can help identify trends and potential reversal points in NIACL’s share price.

4. Volume Analysis: Analyzing trading volume can provide insights into the strength of a trend or potential reversals in NIACL’s share price.

Trading Strategies

Based on the analysis of NIACL’s share price trends, investors can implement various trading strategies, including:

1. Trend Following: Investors can follow trends in NIACL’s share price and enter trades in the direction of the trend.

2. Breakout Trading: Traders can enter trades when NIACL’s share price breaks above or below key levels of support or resistance.

3. Range Trading: Range-bound traders can buy at support levels and sell at resistance levels in NIACL’s share price range.

4. Risk Management: Implementing risk management strategies, such as setting stop-loss orders and managing position sizes, is crucial when trading NIACL’s share price.

Conclusion

Analyzing NIACL’s share price trends requires a comprehensive approach that combines fundamental analysis, technical analysis, and market sentiment. By understanding the factors that influence NIACL’s share price, identifying key levels, and implementing effective trading strategies, investors can make informed decisions and potentially profit from the movements in the stock price.

FAQs

Q1. How can I track NIACL’s share price trends?

A1. Investors can track NIACL’s share price trends by using financial websites, stock trading platforms, and technical analysis tools.

Q2. What are some key factors that can impact NIACL’s share price?

A2. Company performance, industry trends, macroeconomic factors, and market sentiment can influence NIACL’s share price.

Q3. How can technical analysis help in analyzing NIACL’s share price trends?

A3. Technical analysis helps in studying charts, patterns, and indicators to identify trends, key levels, and potential entry and exit points in NIACL’s share price.

Q4. What are some common trading strategies for trading NIACL’s share price?

A4. Trend following, breakout trading, range trading, and risk management are some common trading strategies used for trading NIACL’s share price.

Q5. Why is it important to identify key levels in NIACL’s share price?

A5. Identifying key levels, such as support and resistance levels, moving averages, and volume analysis, can help investors make better trading decisions and manage risk effectively.

Latest Articles

Countdown to Election 2024: Assam's Political Landscape

Exploring the Melancholic Beauty of Jaani Kabhi Shaam Dhale

Exciting Action at French Open 2024 Badminton!